What Causes the S&P 500 to Move?

The S&P 500 , includes the 500 largest publicly-traded companies that trade in the U.S. when ranked by market capitalisation.

The value of the S&P 500 is generated by a company called Ultronics System Corp., which calculates each company’s market capitalisation every 15 seconds. This weighted figure is a measurement that traders can use to track the index’s performance.

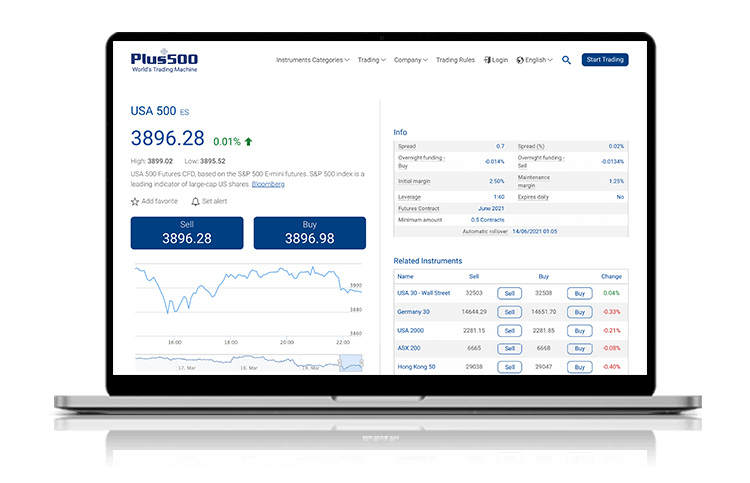

Illustrative prices.

What are the top S&P 500 companies?

S&P 500 companies are chosen by a committee, who make their selections based on several factors. The rankings are adjusted every quarter. Some of the criteria taken into consideration include the company’s market capitalisation, liquidity, domicile, sector classification, and listing exchange.

Some of the selection criteria are compulsory, such as a market capitalization of at least US$9.8 billion and a minimum trading volume of at least 250,000 shares per month. The companies also need to be traded in the United States and traded on the NYSE or NASDAQ exchanges, although there are companies on the list which have never been based in the U.S., or which were once headquartered in the U.S., but which have now moved to other countries.

The 10 largest companies on the S&P 500 are:*

- Apple Inc. (AAPL)

- Microsoft Corp. (MSFT)

- Amazon.com Inc. (AMZN)

- Meta Inc. (FB)

- Tesla Inc.(TSLA)

- Alphabet Inc. Class A Shares (GOOGL)

- Alphabet Inc. Class C Shares (GOOG)

- Berkshire Hathaway Inc. (BRK.B)

- Johnson & Johnson (JNJ)

- JPMorgan Chase & Co. (JPM)

What moves the S&P 500’s price?

At the end of every day, the market capitalizations for the included companies are determined. The total float-adjusted market capitalisation of all S&P 500 stocks is then divided by a proprietary index divisor to derive the closing value of the index. Because of this methodology, the S&P 500 is heavily weighted to favour companies with a higher market cap.

Some things to consider when thinking about how the S&P 500’s price will move include factors such as company earnings per share, revenue, major news involving the companies listed on the exchange, economic data, major political events, and interest rates. Additionally, there is frequently a bump in share price when a company is added to the S&P 500 because mutual funds have to purchase the stock if they wish to represent the index accurately.

The S&P 500 is continuously float-adjusted. The index recalculates when new shares are issued or when a company takes shares off the market through a buyback initiative. The publicly available shares of each company are multiplied by the market value of a single share to determine the company market caps. The market caps are then added together to get the index market capitalisation.

Changes to company market caps are also taken into account through adjustments to the index divisor, which is a proprietary value. The index market capitalization is divided by the index divisor to create the index level, which is more easily reported than the company market caps. The index divisor is the base number used to determine any adjustments that need to be made to account for outstanding shares in any of the component companies of the index.

How do companies get onto the S&P 500?

The S&P 500 committee decides which companies to include. The index is often considered to be a stand-in for the U.S. equities market, as it measures the performance of large-cap stocks.

The S&P 500 committee tries to minimize the amount of change that is made to the index’s components. While the constituent companies are reviewed every three months, care is taken to avoid too much turnover. The selection criteria are only applied strictly to new additions to the index.

*Largest companies as of March 2021